Polimex Mostostal S.A. with higher profit for Q1 2023.

Polimex Mostostal Group publishes strong financial results for Q1 2023.

Despite the still unstable situation in European markets, the war in Ukraine and the resulting problems in the global economy, the consolidated revenues generated by the Polimex Mostostal Group in Q1 2023 reached PLN 825 million.

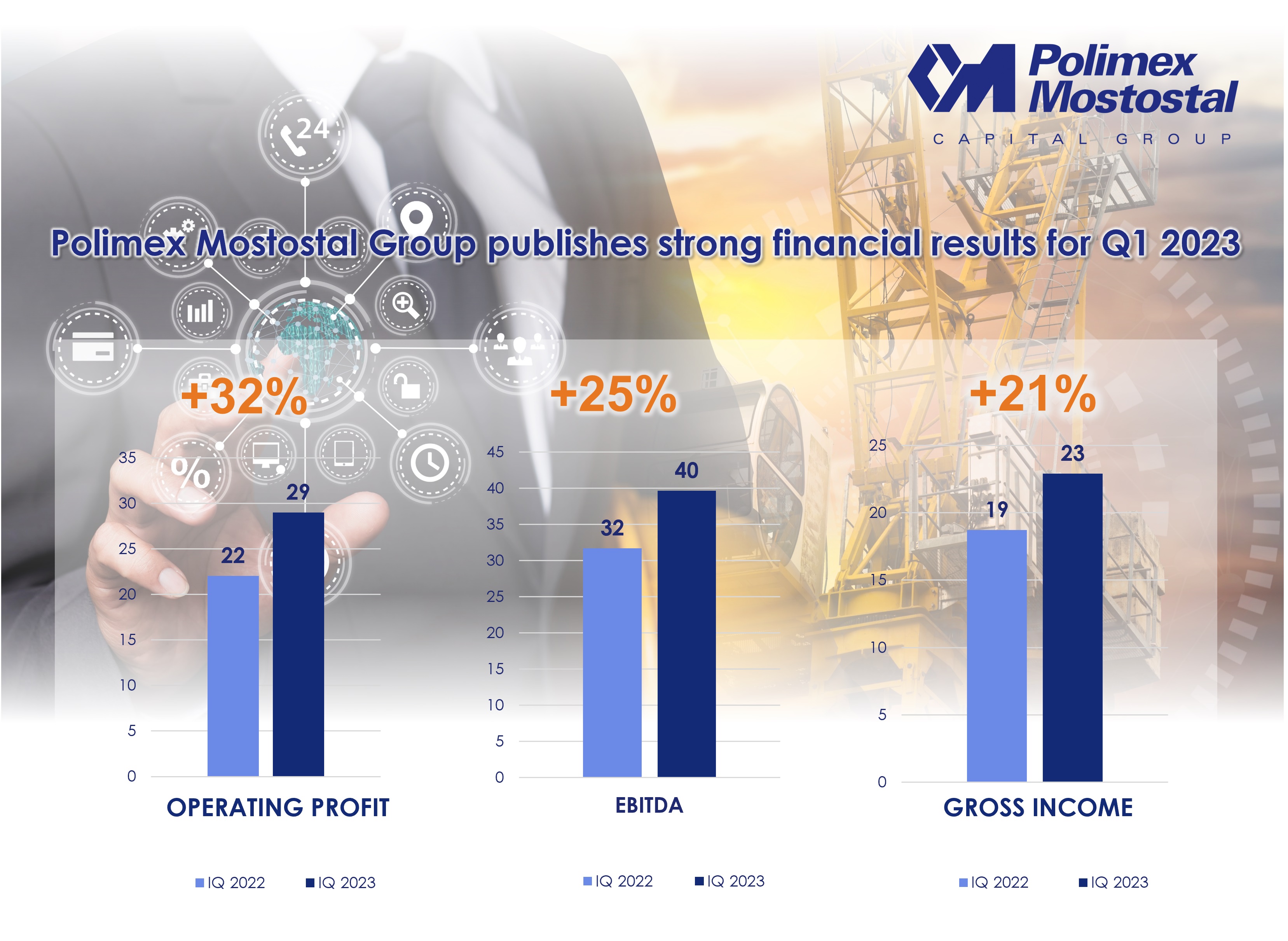

The Group's EBITDA for the first three months of 2023 amounted to PLN 40 million (representing an EBITDA margin of 4.8%) and is PLN 25 million higher than in the same period in 2022 (despite a slight decrease in revenues).

The Group's total net result for the three months of 2023 is higher than that for the first quarter of 2022, amounting to PLN 23 million, representing a margin of 2.8%.

Despite the dynamically changing prices of raw materials and problems with their availability, again as in the past year, the Production and Energy business areas performed best in the reported period - together the two segments accounted for 73% of total revenues.

It is worth noting that in the first quarter of 2023, we signed a new strategic energy contract for the construction of an 882 MW gas-steam unit in Rybnik (value for the entire contractor consortium: 3.05 billion net + 0.76 billion net for subsequent multi-year service)

We are focusing on the implementation of the construction of a coal-fired unit at Zakłady Azotowe Puławy, the construction of new power units at the Dolna Odra Power Plant, as well as at the Czechnica CHP Plant.

We are building up our development competencies in the energy segment in the role of an investor/general contractor in photovoltaic and small cogeneration projects.

Subsequent quarters will depend largely on the availability and prices of materials, and above all on the economic situation in our key industries." - said Krzysztof Figat president of the management board of Polimex Mostostal S.A.

"The Capital Group generated an operating profit of PLN 29 million in Q1 2023 (up 25% year-on-year). In Q1 2023, the best results were generated by the Energy Segment (EBITDA). In Q1 2022, it was the Production segment.

Revenues from foreign sales amount to PLN 200 million and account for 24% of the Capital Group's total revenues. In Q1 2022, the share was 20%.

The financial situation of the Polimex Mostostal Group is stable. We maintain a low level of net debt - at the end of Q1 2023, the cash balance exceeded interest-bearing debt by PLN 259 million.

It is worth noting that our order portfolio at the end of March 2023 is PLN 4.7 billion. We are working to further increase our order portfoliio. We want to increase the share of non-energy projects value in the revenue structure. We are keeping an eye on costs, making sure that we maintain the highest possible business efficiency and profitability of our projects." - Maciej Korniluk, vjce president of the management board of Polimex Mostostal S.A., added.